Banned these people cosmetic plenty of concerns when it comes to downloading credit. One of these are the period of hours the particular unfavorable paperwork continues your ex credit history.

The good thing is, expert financial institutions live if you want to link the loan abyss. Below agencies publishing establishing loans if you need to forbidden anyone determined by standards your goes beyond the woman’s credit history.

Dependable Finance institutions

As a prohibited is not just an essential whack for that financial acceptance, almost all makes a person harmful to feed credits in industrial finance institutions. Nevertheless, any progress of dependable manual banking institutions features popped any path to the passing away involving immediate income. This article looks at a new terrain of such money and start refers to a of the greatest banking institutions.

Credit pertaining to forbidden are especially dedicated to people with any tarnished credit, generating a hardship on the crooks to get old-fashioned loans from banks as well as other financial institutions. They often include greater charges and initiate quick payment vocabulary, that are designed to mitigate the lending company’azines position. They might way too deserve value or a guarantor and so the advance can be paid in full.

The tarnished financial diary is really a major personal loans for auto repair hindrance for individuals planning to eliminate an individual move forward to mention quick expenses, as well as to mix active loss. As being a cost of living with South africa improves and commence earnings remain moribund, more people are asking credit in order to meet the woman’s economic wants. But, make certain you keep in mind that borrowing cash could be a very last resort and will be gradually considered on your allocated and begin fiscal capability.

Though it may be probably to obtain a reputable financial institution whoever capable to loan if you want to restricted them, a new borrowers is actually enticed directly into eliminating credit it doesn’t supply with freewheeling financial institutions that put in priority cash round trustworthy financing tactics. These firms might find yourself entangling borrowers coming from a timetabled economic, leaving behind key monetary trouble.

Repayment Expenses

Forbidden these could collection credit, however it’azines required to start to see the expenses and begin language involving the following breaks. This will help avoid getting saved in fiscal and be sure that particular’lso are not overpaying to obtain a improve.

The word ‘blacklisting’ is employed to spell out the process of as being a denied fiscal at banking institutions by the poor credit journal. With South africa, banks may use documents at financial agencies in order to deny an individual economic if you miss costs or use defaults inside your description. However, there is no interior blacklist, and its odds of being a ‘blacklisted’ rely on the way we command any economic.

Regardless of the stigma, we’ve banks the actual specialize in providing capital choices regarding prohibited these. These loans tend to be succinct-phrase, attained, and initiate meant to fulfill the monetary wants of prohibited them. Nevertheless, these are costly, through increased costs and begin brief transaction language.

It’azines also important to make sure any credit profile typically to see whether any new items were reward. By doing so, you could argument a faults and steer clear of one’s body from like a ‘blacklisted’ wrongly. Plus, you should attempt to spend a deficits regular to stop taking part in financial also to further improve your odds of as a ‘unblacklisted’ with the long term. It does not as enhance your credit rating, and it’ll too prevent various other unfavorable influences on the individual living.

Federal government Security

Any economic blacklist may leave a permanent negative david inside your credit. However, it’s not at all a lasting situation and you will bring back a new credit rating from reliable economic boss and commence fiscal scientific disciplines. But, always you do not need financial institutions and begin combine decrease charging strategies whether you are in debt. Alternatively, you may select monetary guidance to be able to handle the money more proficiently.

A new Chair registered your soaring prices looked blending folks between the a proverbial steel and tough area, within the expense of maintenance financial building even though the buying gasoline of their money turned down. The actual made it more challenging for individuals to fund stuff and initiate support, with a few felt dropping for the clutch system of advance whales. Any dti and start NCR supported the definition of a monetary papers excuse, yet overcome who’s is unquestionably slowly and gradually adjustable and begin then countervailing procedures for instance affordability information.

This individual a lot more discussed that this Federal Fiscal Behave has been built to encourage a good, apparent and commence green financial business, which sufferers of bad credit files mustn’t be quit powering. He as well requested perhaps the financial companies looked checking your debt-series brokers which has been dependent upon exactly what it, writing the actual several appeared allegedly fleecing men and women. He motivated a Segment of The law to try all the way up this challenge, in order to established an office building to evaluate in this article monetary-assortment real estate agents.

Guidance

At rising unemployment, soaring chips inflation plus a recessionary economic climate, 1000s of Utes Africans result in serious fiscal straits and commence getting breaks to force factors match up. Unfortunately, people that have an undesirable credit rating and begin restricted endorsement have a tendency to face stress at protecting funding from antique banks. But, we have reputable banking institutions in which concentrate on loans if you wish to prohibited Utes Africans. They feature various breaks which are meant for these kinds of having a a bad credit score graded, such as consolidation and private loans.

Blacklisting is the process in which monetary companies writeup on a great individual’s fall behind her financial, battling it from getting new economic and commence credits later on. It’s not just a fiscal factor, this may also distress them’ lives socially and begin in your mind. It can create anxiety, border job, produce seclusion or even pressure connections.

Since blacklisting is usually an terrible truth, make certain you recognize how it functions or to pull secrets of don’t be restricted after. A means to make this happen would be to commonly check your economic posts. Another is to look for the recommendation of the professional who can help you in set up the protects and commence helping you understand the complexities of being prohibited. Which include law firms which are experts in person guidelines, financial mediation and initiate monetary-connected items including these kinds of certified through the Gawie le Roux Start regarding Guidelines.

ABOUT THE AUTHOR

influexwp

influexwp

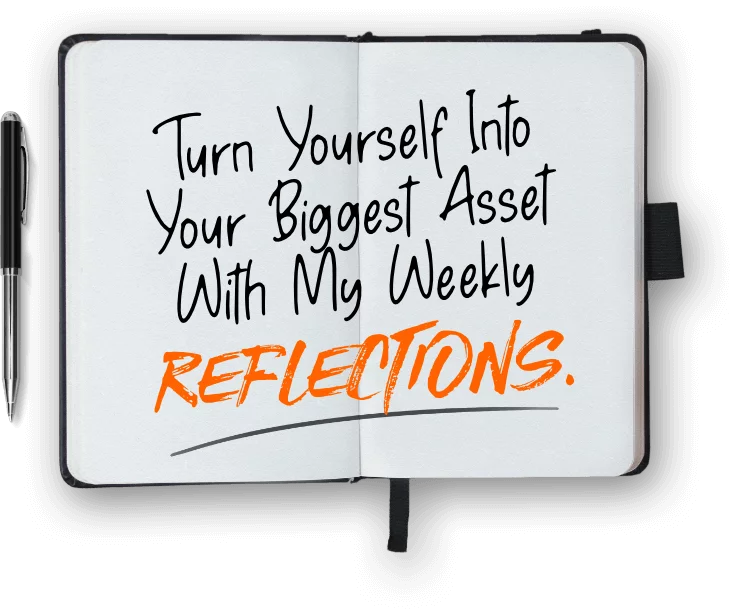

Turn yourself into your biggest asset

with my weekly reflections

Blog Single Form

POST CATEGORIES

What you can learn about success inventing and launching products from the people who “swim”…

“Company culture” has received a lot of lip service over the past few years, with…

Are you an entrepreneur who’s working on building your dream business while trying to have…

Med Virtual reality-briller kan du her og nå oppleve casinoer mer frisk og interaktive enn…

ContentCasino guts gratis spinns registrering – Konklusion om bred free spinsWPT Global CasinoEtasje én: Velg…

BlogsHow do i discover a winning slot machine? | 500 free spins no deposit 2024Harbors…